Time is certainly running short now. President Trump’s big tariff deadline is approaching in only two weeks. Pressure is mounting across the whole world right now. Canada and Japan are still scrambling to finalize trade deals. It feels like a race against time unfolding right before our eyes. Many people will feel the effects of the final outcome.

Those tariff pauses are ending soon, on July 9th. Nations could suddenly face quite high new tariffs. The rates may become much higher than the current 10%. Everyone feels some level of nervousness about this. Strange things happen as countries try to figure things out. Businesses and central banks are also reacting.

Let’s take a closer look at the current tariff drama. We’ve gathered some striking effects that are happening now. The July 9th deadline looms large here. See how trade impacts washing machine prices. Stock prices are also feeling the effects of this global situation.

1. **Pressure Ramps Up Before the Deadline**: The intense push for trade deals is very real. Only two weeks remain before President Trump’s deadline. According to reports, talks with key partners are still at a standstill. This creates a strong sense of urgency right now. If deals fail by July 9th, countries may face stiff tariffs. This push follows Trump’s recent warnings about tariff rates.

New tariffs might be much higher than 10%. Trump paused his most punishing duties, known as the “Liberation Day” tariffs. That pause ends precisely on July 9th. Up until this point, only the UK has secured a deal. Their deal did not resolve everything, such as steel tariffs. Many nations are now racing to reach an agreement with Trump’s team.

The clock is ticking quickly for nations like Canada and Japan. The pressure feels quite palpable as the deadline approaches. People feel the urgency to get things done. Higher tariffs could trigger market reactions. Previous “Liberation Day” tariffs caused similar issues.

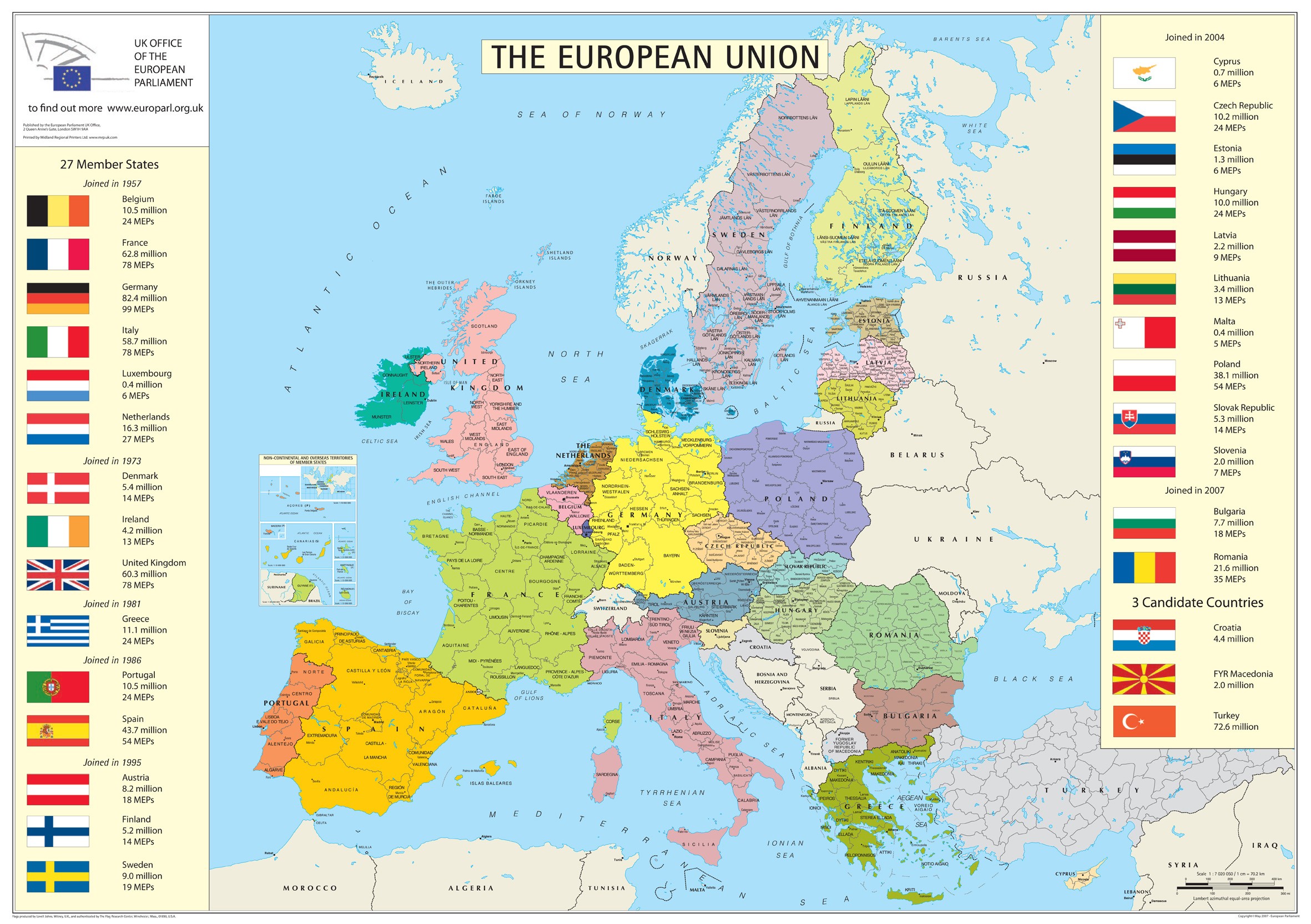

2. **EU’s Push for a UK-Style Deal (and the 10% Baseline)**: Across the pond, the European Union is working. It is pushing for a trade deal similar to the US-UK one. This is happening despite the ongoing talks being stalled here. The Financial Times reported that the EU seeks a UK-style agreement. The EU is trying to find a path amidst tariff tensions here.

Officials in the EU are now anticipating something. A 10% reciprocal tariff may initiate negotiations. Five sources confirmed this expectation very recently. EU negotiators are attempting to push for a lower rate. However, negotiating has become harder since the US started drawing revenue. Getting the baseline rate feels quite challenging today.

Pushing for a UK-style plan would allow some tariffs to remain. This could happen after the July 9th deadline approaches. It could help prevent retaliation against Washington. The EU now appears resigned to the 10% baseline. President Trump threatened tariffs of up to 50% on EU goods. This comes after the pauses end on July 9th. The EU hopes that the deadline will be extended during the talks.

3. **Household Goods Face Higher Prices**: Get ready now for future changes. President Trump’s tariffs will impact goods for your home. Starting Monday, these tariffs will apply to appliances. Washing machines, fridges, and ovens will be affected. This may mean higher prices here in the US.

New tariffs will add to the existing 50% steel tariffs. This also applies to some steel items now. The Commerce Department says duties will hit the steel content inside goods. Not just raw materials will feel the pinch here. How steel is used affects the costs passed down.

This shows the potential costs for consumers very clearly. Tariffs on big appliances will impact wallets hard. Tariffs on household goods will bring home the costs of the trade war. One report stated this consequence directly. It is a direct way that policy affects your money.

Read more about: Decoding High Egg Costs: Bird Flu, Lawsuits, and What’s Next for Your Wallet

4. **Canada’s Counter-Threat on Steel and Aluminum**: Things have heated up suddenly in the north of Canada. Prime Minister Justin Trudeau’s government has threatened action. They might hike tariffs on US steel and aluminum. This follows Trump’s raising of levies to 50%. It shows a classic back-and-forth in a trade war.

Canada does not seem to be backing down easily. Their threat shows a willingness to push back. This is happening in response to US duties on their exports. Reports confirm that Canada is threatening higher tariffs. This adds tension to the neighborly trade talks that are starting.

Trump and Trudeau seemed positive about reaching a deal. They expressed optimism at the recent G7 summit. This gives mixed signals about the situation. High-level talks mix threats and hope together. They are racing to reach an agreement faster.

5. **The Fed’s “Wait-and-See” on Inflation**: Even big economic players are trying to sort this out. The US economy is handling tariff effects carefully. The Federal Reserve has remained very cautious lately. Chair Jerome Powell spoke, holding interest rates flat. The Fed is waiting to see the tariff effects on prices. He said the Fed stays in “wait-and-see mode.”

High uncertainty exists about cost pass-through. How much of the tariff cost reaches consumers is unknown. Powell said the pass-through of tariffs to consumer prices is uncertain. “We just don’t know how much is passed through,” he stated. This was said during his House testimony recently. “We won’t know until we see it,” he finished clearly.

Powell called the pass-through to consumer prices a process. He said this process is very uncertain for all parties involved. Many parties are in that whole chain: manufacturers, exporters, importers, retailers, and consumers. Each one tries to avoid paying, or one ends up paying all. Predicting cost distribution is very hard. We have not seen this situation before. They are waiting to gather more necessary data now.

6. **Anticipating Higher Inflation in June/July**: Despite uncertainty about the final impact on things, Fed Chair Jerome Powell has shared some expectations now. He anticipates seeing more effects of tariff-induced inflation. This might show up in the third-quarter reports. He mentioned June and July data specifically. Powell expects to see accelerated inflation data soon.

He noted that he had met many business leaders recently. It was an unusually large number, he stated. Businesses often sold inventory from February. Many Trump tariffs were not included in the cost of goods then. As older inventory clears, tariffs show up. This should lead to the anticipated uptick quickly.

They expect “accelerated inflation in June and July data.” The timing for seeing some impact seems clearer now. While the total pass-through remains a mystery, he said, the waiting game continues until they see the full picture. They need to learn more before reacting strongly.

7. **Metals Duties Hit Packaging**: Think about something you might not first guess. Tariffs on imported steel and aluminum have a broader impact. They directly affect packaging like cans and cartons. Companies using these materials become “collateral damage.” Reports show that this situation is happening now.

Duties on imported steel and aluminum have doubled. They increased sharply to 50% on June 4th. This increase has hit many US companies hard. Costs for packaging materials have gone up swiftly. Many companies in the US have become collateral damage. Reuters reports confirm this occurrence clearly. Tariffs on one sector affect many others here.

Not only car makers feel the pinch from metal tariffs. Construction companies also face this issue. Businesses using metal packaging deal with the fallout. This shows that global supply chains are well-linked. Tariffs create unexpected issues further down the line here. They directly affect the containers your food comes in.

8. **European Banks Face Stress**: Tariff situation impacts more than products or prices. It makes waves in the financial sector too. Bloomberg News reports European banks may suffer. Their profits could take a hit now. An S&P trade war stress test showed this result.

Banks connect deeply to the global economy. If companies and countries struggle with costs. Reduced trade affects financial institutions naturally. Uncertainty from tariffs impacts lending banks strongly. The stress test results show this vulnerability. It shows how trade war bites bank profits deeply.

People discuss tariffs affecting goods and prices commonly. Their reach extends to bank stability too. Trade war creates ripples felt across sectors. This includes finance showing broad consequences easily. It even touches seemingly removed things like bank profits very clearly.

Related posts:

Trump tariffs live updates: Pressure on to seal trade deals before Trump’s deadline

Trump tariffs live updates: Pressure on to seal trade deals before Trump’s deadline

B.C. ostriches won’t ‘necessarily’ be killed, says Canada’s agriculture minister